What do I need to know about forming a Partnership Firm?

What do you mean by 'Partnership'?

As per the definition under section 4 of the Indian Partnership Act, 1932, a partnership is “the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. In layman's terms a ‘partnership’ is basically a contract of two or more competent persons to place their money, effects, labour and skill in lawful commerce or business and divide the profits and bear the loss in certain proportions, as agreed upon.

Do I need a Partnership Firm?

A partnership firm isn't always required, you can start your business as a sole proprietorship. However, a sole proprietor may not be in a position to cope with the financial and managerial demands of the present-day business world. As a result, two or more individuals decide to pool their financial and non-financial resources to carry on a business.

What does forming a Partnership mean?

Under the Indian Partnership Act, of 1932, the following three elements are very essential to form any firm of partnership in India (a) an agreement between two or more persons (b) a profit-sharing ratio and (c) all or any partners must carry on the business. These three essentials must co-exist to bring a partnership firm into existence.

How easy is it to register a Partnership Firm?

Forming a partnership firm is quite simple and quick, you need to have a unique name, pre-decided rights and responsibilities of each partner including the profit-sharing ratio that is to be drafted in the partnership deed, and a stamp paper. Additionally, if you want the firm to have legal recognition, get the application filed with the Registrar of Firms in the jurisdiction where the firm is located.

Types of Partnership Firm

There are 2 types of partnership firm

A registered partnership firm is where a legal partnership deed has been drafted, indicating the agreed terms, conditions, and the profit-sharing ratio among the partners and the same is submitted along with the firm registration form to the Registrar of Firm in the jurisdiction where the firm is located. This legal registration gives a legal identity to the partnership firm and allows it to sue any person.

On the other hand, an unregistered firm or any of its partners cannot initiate legal proceedings, claim set-offs, or engage in other legal actions in disputes with third parties.

However, with effect from the assessment year 1993-94, no distinction is made between a ‘registered firm’ and an ‘unregistered firm’ for taxation. The income of all firms (irrespective of registration) is chargeable at the flat rate of 30%

Features of a Partnership Firm

Features of a partnership firm are as follows:

- Existence of an agreement: As per section 5 of the Indian Partnership Act, 1932, a partnership arises from a contract between two or more parties and not from status, as in the case of HUF (Hindu Undivided Family). A formal or written agreement is not necessary to create a partnership.

- Business: A partnership can exist only in business. Thus, it is not the agreement alone which creates a partnership. A partnership comes into existence only when partners begin to carry on business in accordance with their agreement. Section 2 (b) of the Indian Partnership Act, of 1932 only states that business includes every trade, occupation and profession.

- Sharing of profit: The persons concerned must agree to share the profits of the business. Because no person is a partner unless he or she has the right to share the profits of the business. Section 4 of the Indian Partnership Act, of 1932 does not insist upon the sharing of losses. Thus, a provision for sharing of loss is not necessary.

- Mutual agency: It means that the business is to be carried on by all or any of them acting for all. Thus, if the person carrying on the business acts not only for himself but for others also so that they stand in the positions of principals and agents, they are partners.

- Minor as a partner: A minor can be added to a partnership firm. But the condition is that he can be admitted to share profit only. He cannot be made to share the losses of the firm. If the partnership firm suffers a loss then it will be borne by other major partners in their profit-sharing ratio.

- Number of Partners:

- Minimum Partners: Two

- Maximum Partners: Rule 10 of Companies (Incorporation) Rules 2014 specifies the limit as 50. Thus, the maximum number of members in a partnership firm is 50.

What are the advantages of forming a Partnership Firm?

The advantages of Partnership are as follows:

- Easy Formation – Forming a partnership firm in India is relatively simple with fewer legal formalities compared to other business structures.

- Shared Capital Contribution – Unlike sole proprietorship where every contribution is made by one person, in partnership, partners of the firm can contribute more capital and other resources as required.

- Shared Management – In a partnership firm, all partners actively participate in decision-making. This flexibility allows for quicker decision-making without formal board meetings, unlike companies.

- Shared Risk & Responsibility – All loss incurred by the firm is equally distributed amongst each partner thereby reducing individual burden.

- Combination of different skills – The partnership firm has the advantage of knowledge, skill, experience and talents of different partners.

What are the disadvantages of forming a Partnership Firm?

The disadvantages of Partnership are as follows:

- Unlimited Liability: The partners have unlimited liability, meaning they are personally liable for the firm's debts. If the firm's assets are insufficient to cover its liabilities, the personal assets of the partners can be used to repay the debts.

- Limited Funds: Although capital contributions come from multiple partners, a partnership firm's ability to raise funds is limited compared to a corporate business structure like OPC, Pvt Ltd, or LTD.

- Higher conflict chances: Conflicts between partners are higher because of differences of opinion in matters relating to decision-making, profit-sharing, or management roles.

- Continuity Issues: The firm may automatically dissolve due to a partner's death, withdrawal, or insolvency unless provisions are made in the partnership deed.

- Slower growth: Limited capital and management constraints slow the growth potential of partnership firms. Scaling a business or expanding into new markets can be difficult.

Procedure of Registering a Partnership Firm

The procedure of forming a partnership firm in India involves the following steps:

Step 1: Application for Digital Signature

Obtain a DSC for all partners. As per guidelines, applications for the DPIN are to be applied online on the MCA portal which requires the digital signature of all partners. Proposed partners must acquire a Class 2 or Class 3 DSC.

Step 2: Apply for DPIN (Designated Partners Identification Number)

After securing the DSC, partners must apply for a unique DPIN through the MCA portal. This identification number is required for all partners.

Step 3: Apply for Name approval

The next step is that you'll need a unique name for your partnership firm which should not be identical or similar to any existing company or LLP and must comply with legal naming regulations.

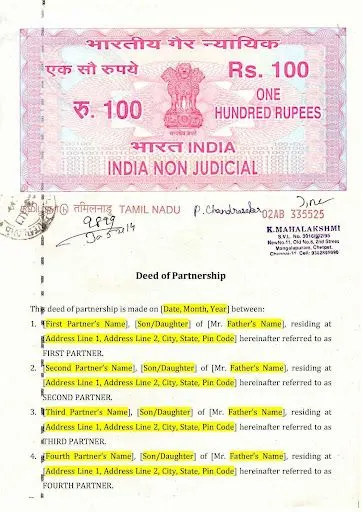

Step 4: Draft the Partnership Deed

The relationship between the partners is governed by a mutual agreement known as a partnership deed. It should be comprehensive to avoid disputes later on. The deed should include the firm's name, partner names and addresses, business nature, profit-sharing ratio, and the partnership's duration. Get the physical copies of the partnership deed on stamp paper and get it signed by all partners.

Step 5: Apply for Registration with the Registrar of Firms

The next step is to fill out the partnership firm registration form and submit it to the registrar of firms along with the partnership deed for registration of the partnership firm.

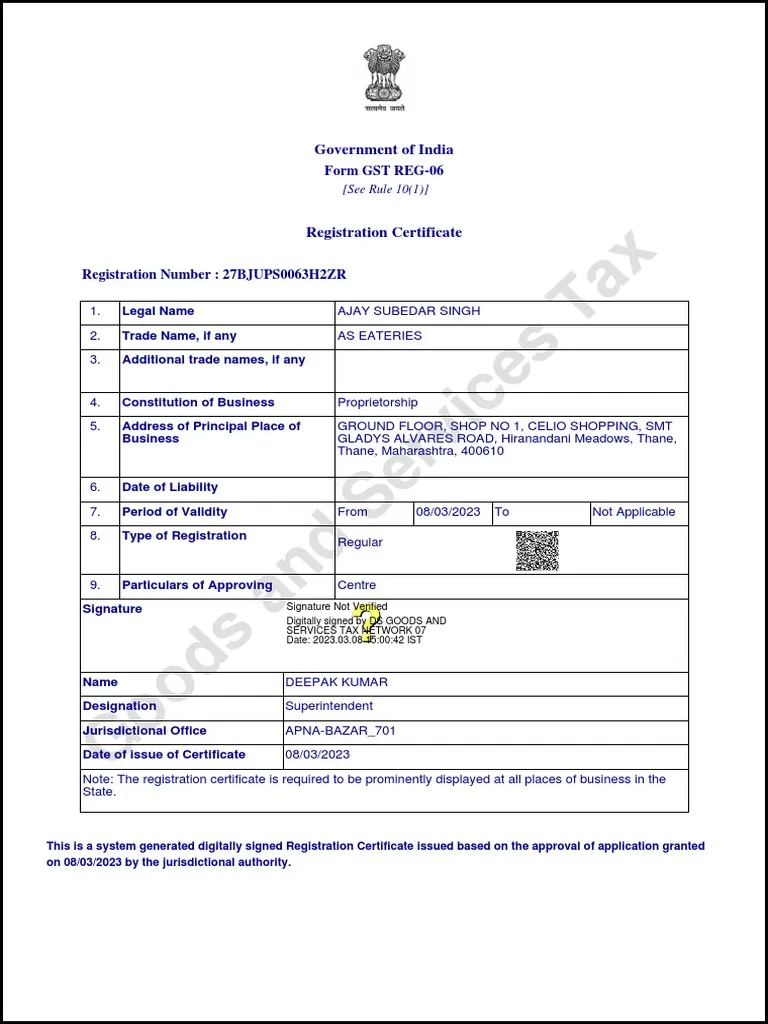

Step 6: Receive Certificate of Registration

The Registrar of Firms will verify the application, if the Registrar is satisfied with the application, a Certificate of Registration will be issued to confirm the partnership deed registration. This certificate proves the firm's registration with the Registrar of Firms.

Step 7: Apply for PAN & TAN

Upon the partnership firm's registration, the partners must apply for PAN & TAN of the firm from the Income tax department.

Step 8: Opening of Bank Account in India

Once the PAN is obtained, the firm will be eligible to open a current bank account. Chartered ONE offers multiple banks to choose from, with the process being entirely remote & streamlining the experience for you.

Step 9: PT, ESI, EPF Registration

ESI registration is required when the employee count is 9 and EPF registration is required when the employee count is 20. A voluntary registration option is also available even if below the threshold limit. Professional Tax is applicable in some states based on the earnings of the employee. Ensure a smooth ESI, EPF, and PT registration for your Company with Chartered ONE's expert guidance.

Document required for Partnership Firm Registration

The following documents are required for registering a Partnership Firm in India:

- PAN of Partners

- AADHAR of Partners

- Rental Agreement

- Electricity Bill

- NOC from Landlord

What is the Government fee for Partnership Firm Registration?

The government fee is the stamp duty charge for the registration of a partnership firm which is state-specific. The Government Fee applicable for the partnership firm registration varies from state to state depending on the partner's contribution.

The laws regarding stamp duty vary across different states in India.

- In Andhra Pradesh, the stamp duty is Rs. 100 for capital up to Rs. 5000, while it is Rs. 500 for other cases.

- In Arunachal Pradesh, the stamp duty is Rs. 30 for capital up to Rs. 1000, while for other cases, it is Rs. 100.

- In Assam, the stamp duty is Rs. 20 for capital up to Rs. 1000, while for other cases, it is Rs. 100.

- Jharkhand & Bihar's stamp duty is 2.5% of the capital disclosed, with a maximum of Rs. 10,000, and Rs. 10,000 if the capital is not disclosed.

- In Chhattisgarh, for capital up to Rs. 50,000, the stamp duty is Rs. 1000, and for capital exceeding that, it is 2%, with a maximum of Rs. 5000.

- In Delhi, 1% of the capital is charged as stamp duty, with a minimum of Rs. 200 and a maximum of Rs. 5000.

- Goa charges Rs. 500 for capital below Rs. 50,000, and Rs. 500 is added for each additional Rs. 50,000, with a maximum of Rs. 5000

- In Gujarat, Rs. 1 is charged for every Rs. 100 of capital, with a maximum of Rs. 10,000.

- In Haryana, the stamp duty is fixed at Rs. 1000 across all categories.

- In Jammu & Kashmir, for capital up to Rs. 50,000, Rs. 1000 is charged, and for amounts exceeding Rs. 50,000, 2% is charged.

- Karnataka's stamp duty is fixed at Rs. 2000 across all categories.

- Kerala imposes a flat rate of Rs. 5000 across all capital levels.

- Madhya Pradesh has a minimum charge of Rs. 2000 and a maximum of Rs. 10,000 at a standard rate of 2% of the capital.

- Maharashtra charges Rs. 500 for capital up to Rs. 50,000, and 1% for amounts exceeding Rs. 50,000, with a maximum of Rs. 15,000.

- Orissa charges Rs. 50 for capital up to Rs. 500, and Rs. 2000 for other cases.

- Punjab charges Rs. 4 for capital up to Rs. 500, and Rs. 1000 for other cases.

- Rajasthan imposes Rs. 2000 for every Rs. 50,000, with a maximum of Rs. 10,000.

- Tamil Nadu charges Rs. 50 for capital up to Rs. 500, and Rs. 3000 for other cases.

- Telangana charges Rs. 100 for capital up to Rs. 5000, and Rs. 300 for all other cases.

- Himachal Pradesh, Tripura, Manipur, Meghalaya, Mizoram, Sikkim, Tripura, and Nagaland all charge a uniform rate of Rs. 100.

- Uttar Pradesh and Uttarakhand both charge Rs. 750 across all categories.

- Finally, West Bengal charges Rs. 150 uniformly across all capital levels.

Expert assisted process

Instant Partnership deed drafting

Deed submission to the local registrar on your behalf

Application for partnership firm's PAN & TAN card

Zero balance current account opening

Expert assisted process

Instant Partnership deed drafting

Deed submission to the local registrar on your behalf

Application for partnership firm's PAN & TAN card

GST registration

GSTR-1 & 3B for 6 months

Partnership firm ITR Filing for one financial year

Zero balance current account opening

Expert assistant process

Instant Partnership deed drafting

Deed submission to the local registrar on your behalf

Application for partnership firm's PAN & TAN Card

Zero balance current account

GST registration

GSTR-1 & 3B for 12 months

Trademark Registration for Your Brand

Partnership firm ITR Filing for one financial year