What do I need to know about forming my Limited Liability Partnership?

What is a Limited Liability Partnership?

A Limited Liability Partnership is a corporate form of partnership firm you can register that is recognized under the LLP Act 2008. The primary objective of an LLP is to give the entity a separate legal structure while limiting the personal liability of its partners. This means that the partners in an LLP will not be personally liable for the firm's debts or liabilities, unlike a traditional partnership firm.

Do I need a Limited Liability Partnership?

A Limited Liability Partnership isn't always required. Still, many small business partners choose to incorporate an LLP because of its flexible partnership structure with limited liability protection. Forming an LLP is more beneficial for startups with co-founders, venture capitalists, professional consultants, Design firms, real estate agencies, small & medium-sized businesses, etc.

What does Limited Liability Partnership Registration mean?

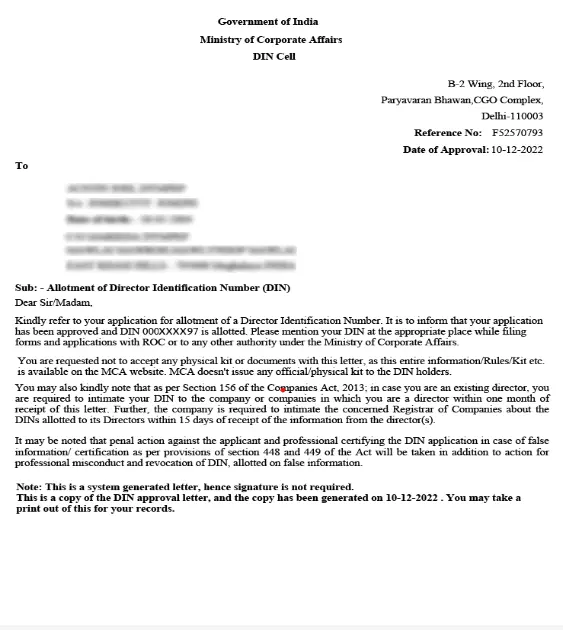

When you incorporate a Limited Liability Partnership, you need to reserve a unique name, draft a partnership agreement, file FiLLiP and get it certified by a practising professional (CA/CS/CWA). Upon approval of registration with the MCA, the LLP will get a certificate of incorporation containing LLPIN and 2 DPINs (Designated partners identification number). You can then use this separate entity to record your business expenses, take on business debts, file taxes, obtain government licenses, and more—and this is what gives you liability protection.

How easy is it to form a Limited Liability Partnership?

You may be slightly intimidated by the idea of forming a legal entity like a Limited Liability Partnership, especially if it's your first time. All you need is an understanding of what your business will do, how you plan to run it, a unique name for your business, and an address for registration which can also be your home address, then reach out to Chartered ONE team, we will take care of the rest.

Benefits of Registering a Limited Liability Partnership

Some of the benefits of registering a limited liability partnership are: it is a separate legal entity which means partners are not personally liable for the losses, partners have direct management control allowing them to participate actively in the decision-making process, post incorporation of an LLP there is no restriction on the number of partners, Additionally, there is no minimum capital requirement, and as a corporate structure the credibility of the business is increased.

Benefits of Registering a Limited Liability Partnership:

- Separate Legal Entity: A Limited Liability Partnership is a separate legal person with its own legal rights and obligations that are separate from partners. This means the liability of the partners has certain limitations in their contribution to the LLP. Hence, the creditors of the LLP are not the creditors of individual partners.

- Perpetual existence: Unlike a general partnership firm, a limited liability partnership can continue its existence even after the retirement, insanity, insolvency or even death of one or more partners. Further, it can enter into contracts and hold property in its name.

- Direct Control on Management: The partners of an LLP have the right to manage the business directly.

- No Restriction on partners: Post-Incorporation of an LLP, there is no restriction on the number of partners, unlike a traditional partnership firm.

- Increased Credibility: Forming an LLP, gives the business a corporate structure that improves credibility amongst suppliers, lenders, buyers, banks, and any other third party.

Limited Liability Partnership Registration Process

The procedure of forming a Limited Limited partnership in India involves the following steps:

Step 1: Application for Digital Signature

As per guidelines, all applications to the Registrar of Companies are filed in digital format and are therefore required to be authenticated using a digital signature of the authorized signatory. Proposed partners must acquire a Class 2 or Class 3 DSC to sign the FiLLip form online. Chartered ONE offers Digital Signature service, fulfilling this requirement of obtaining a DSC for ROC fillings.

Step 2: Applying for Name approval

The next step is to file a RUN-LLP web form to reserve the unique name of the LLP. Chartered ONE ensures you secure your dream company name during an initial availability check. However, if your preferred name is already registered, we provide unlimited alternative company name searches to help you find the perfect fit.

Step 3: Filing FiLLiP form for registration of LLP

Application for registration is drafted using FiLLip form, a simplified proforma for LLP registration electronically. The application must be accompanied by the required documents including the subscriber’s sheet and registered office address proof and need to be attested by the partners through PAN-based DSC and certified by the practising professional (CA/CS/CWA). Chartered ONE makes your LLP formation easy and simple for you.

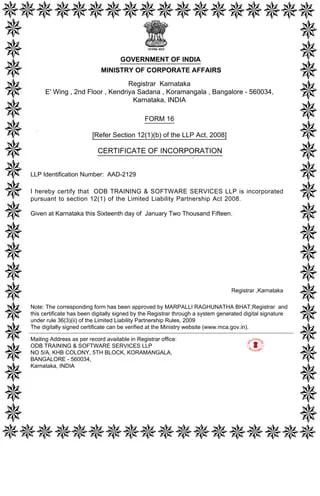

Step 4: Receive Certificate of Incorporation of LLP

Upon successful verification by the ROC, you will receive a Certificate of Incorporation consisting of LLPIN in form 16 along with DPIN allotted to the designated partners

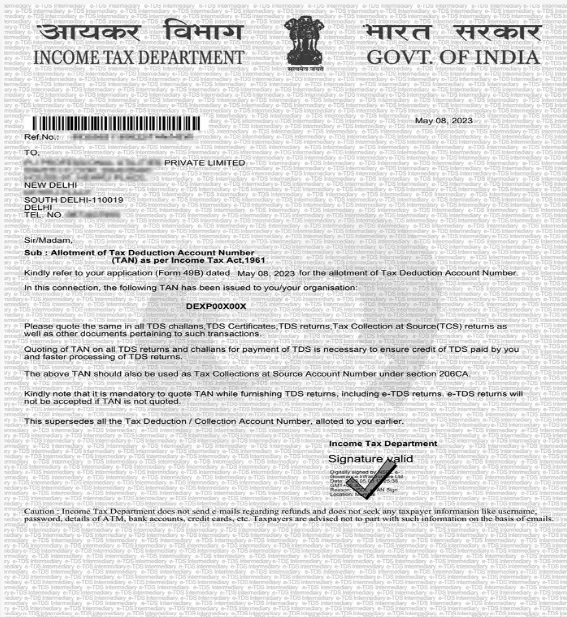

Step 5: Apply for PAN & TAN

Upon successful incorporation, you will need to apply for PAN & TAN of the LLP to the Income tax department providing the certificate of incorporation as the supporting documents.

Step 5: Opening of Bank Account in India

Once PAN is obtained, the LLP will be eligible to open a current bank account. Chartered ONE offers multiple banks to choose from, with the process being entirely remote & streamlining the experience for you.

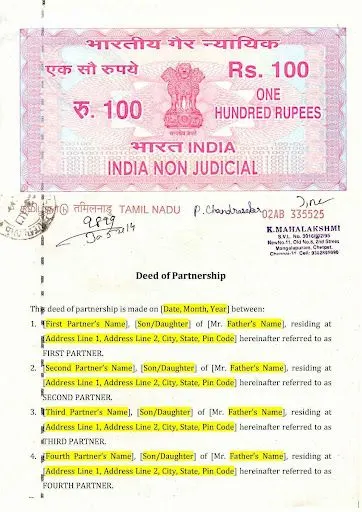

Step 6: File Form 3

A signed, stamped & notarized LLP Agreement must be filed in Form 3 within 30 days of Incorporation.

Step 7: PT, ESI, EPF Registration

ESI registration is required when the employee count is 9 and EPF registration is required when the employee count is 20. A voluntary registration option is also available even if below the threshold limit. Professional Tax is applicable in some states based on the earnings of the employee. Ensure a smooth ESI, EPF, and PT registration for your Company with Chartered ONE's expert guidance.

Document required for Limited Liability Partnership Registration

Checklist of Documents Required for Forming Limited Limited Partnership are:

- PAN of all partners

- Aadhaar copy of all partners

- Passport-size photo of all partners

- Subscriber sheet duly signed by all partners

- Rental agreement copy if the registered office is rented.

- Copy of utility bill (water/gas/electricity) of the rented property

- No Objection Certificate from the owner of the property

Limited Liability Partnership Registration Fees

Limited Liability Partnership Registration Government Fees

The government fees for FiLLiP filing are structured based on the contribution value. For contributions of up to ₹1,00,000, the fee is ₹500. For contributions exceeding ₹1,00,000 and up to ₹5,00,000, the fee increases to ₹2,000. If the contribution falls between ₹5,00,000 and ₹10,00,000, the fee is ₹4,000. For contributions over ₹10,00,000, the fee is ₹5,000. Additionally, there is a name reservation fee for the RUN form of ₹200, and the filing fee for Form-3 is ₹50.

Below is the table for better clarity on Government Fees for FiLLiP filing:

| S. No. | Contribution Value in ₹

| Fee Payable in ₹

|

| 1. | Up to 1,00,000

| 500/- |

| 2. | More than 1,00,000 up to 5,00,000

| 2,000/- |

| 3. | More than 5,00,000 up to 10,00,000

| 4,000/- |

| 4. | More than 10,00,000

| 5,000/- |

- Name Reservation Fees of Run Form – ₹ 200

- Form- 3 Filing Fees – ₹ 50

What are the forms to be filed for Limited Liability Partnership Registration?

E-Forms to be Filed for Limited Liability partnership

- LLP RUN Form

- FiLLiP Form

- Form 3

Disadvantages of forming an LLP

The disadvantages of forming an LLP are:

- Limited Funds: LLPs have limited options when it comes to raising funds. They can either borrow debt from financial institutions or obtain loans from partners. Also, Foreign Direct Investment (FDI) in LLP is more restrictive as compared to companies. Moreover, an LLP can issue Employee Stock Options (ESOP).

- Public Disclosure of Financial Statements: The LLP needs to file its Financial Statement through the MCA portal every year which becomes a public document. Any person can pay a small fee of INR 50 and can get a copy of the LLP’s incorporation documents, financial statements etc.

- Increased cost of compliance: Unlike a partnership firm, an LLP needs to file annual returns, maintain proper records and meet specific regulatory requirements on any changes made post-incorporation. This increases the cost of compliance.

- High penalty on non-compliance: Being a corporate structure an LLP has a heavy penalty for non-compliance just like a private limited company.

Instant Drafting, filing & Consultation with CA/CS

DSC for 2 Partners

4 Name reservation choices & Instant filing in 24hrs

FILIP

Registering LLP with Ministry of Corporate Affairs

Allotment of LLPIN & 2 DPINs in 7 days

Free Bank Account opening

Instant Drafting, filing & Consultation with CA/CS

DSC for 2 Partners

4 Name reservation choices & Instant filing in 24hrs

FILIP

Registering LLP with Ministry of Corporate Affairs

Allotment of LLPIN & 2 DPINs in 7 days

PAN, TAN, ESI & PF Registration in 7 days

Form 3 filing

Free Bank Account opening

GST Registration in 24hrs

Income tax return filing

Form 11 (Annual return of LLP)

Form 8 (Statement of Accounts) and DIR-3 eKYC of Directors

GST Filing for 6 months by CA

Instant Drafting, filing & Consultation with CA/CS

DSC for Partners

4 Name reservation choices & Instant filing in 24hrs

FILIP

Registering LLP with Ministry of Corporate Affairs

Allotment of LLPIN & 2 DPINs in 7 days

PAN, TAN, ESI & PF Registration in 7 days

Free Bank Account opening

Form 3 filing

GST Registration in 24hrs

Income tax return filing

Form 11 (Annual return of LLP)

Form 8 (Statement of Accounts) and DIR-3 eKYC of Directors

GST Filing for 12 months by CA

Trademark application for your brand