About the Federation of Indian Export Organization

The Federation of Indian Export Organisation, popularly known as FIEO, was set up in 1965 as an apex body of Export Promotion Organisations in India. It is an organisation that promotes and assists Indian exporters including access to international market information, policy advocacy, trade promotion, and networking opportunities.

It has been designated as the Registering Authority for status-holder exporting firms and other exporters dealing in multi-products. It issues a Certificate of Origin (Non-Preferential) required by many countries as proof of origin of the goods.

FIEO also provides the crucial interface between the international trading community of India and the Central and State Governments, financial institutions, ports, railways, surface transport and all engaged in export trade facilitation. It provides vital inputs to the Government on various matters of trade.

What are the activities undertaken by the FIEO?

- FIEO organises interactive meetings with the policymakers to draw the attention of the Government on important trade issues and help speedy resolution.

- FIEO is an imperative part and provides vital inputs on various trade policies to various Committees and Task Forces set up by both Central and State Govt.

- FIEO will keep you updated with the latest developments in the international trade sector through continuous e-mailers and also through its website.

- Exchanges business delegations, establishes MoUs with counterpart organisations overseas, and arranges exhibitions, and catalogue shows abroad.

- FIEO actively represents the interests of its members and the broader export community in policy advocacy. They engage with government agencies to address issues related to export regulations and incentives

- FIEO actively promotes "Brand India" by supporting Indian exporters in producing high-quality goods and services that meet global standards and by promoting these products in international markets.

Who can become the registered member?

If you are engaged in the manufacturing, processing, or exporting of products not covered by any Export Promotion Council / Commodity Board or if you are in multiple product business and you hold a valid Import Export Code (IEC) number, which is issued by the Office of the Director General of Foreign Trade (DGFT), you will be eligible to become the registered exporter and can obtain e-RCMC from Federation of Indian Exporters Organisation (FIEO)

The federation provides the following categories of membership for Exporters:

Ordinary Member: A person holding a registration cum membership certificate from any other Export Promotion Council or Commodity Board or Export Development Authority is eligible to become an Ordinary member of the Federation.

Registered Member/Others: The following shall be eligible to become a registered member of the Federation.

- Multi Product Group exporter

- Unit set up under the Export Oriented Unit (EOU) Scheme, Electronics Hardware Technology Park (EHTP) Scheme, Software Technology Park (STP) Scheme, Bio-Technology Park (BTP) Scheme or unit located in Special Economic Zone (SEZ) including Free Trade and Warehousing Zones (FTWZ) governed by the provisions of the SEZ Act

- State Export Organisations

- Bank or Banking Institutions

- Service Providers/ Consultancy/ Contractor firms

- A person engaged in exports (other than Ordinary Member or Associate Member)

- Institutions of Higher Learning in International Trade

- Any export packaging organization, trade association, chamber of commerce or any other similar organization.

|

Associate membership: Any Status Holder i.e. exporters holding a valid recognition certificate, for their outstanding export performances, issued by the Directorate General of Foreign Trade shall be eligible for Associate membership of the Federation

FIEO offers different group categories based on the nature and size of your export business. Choosing the right membership depends on your company turnover or status.

| Multi-Product Group | If you are engaged in the business of multiple products and your turnover is less than Rs 5 Cr, you may apply for the Muti Product group category RCMC |

| Premium Multi-Product Group | If you are engaged in the business of multiple products and your turnover is more than Rs 5 Cr, you may apply for the Premium Muti-Product group category RCMC

|

| Service provider | If you are a service provider and your turnover is less than Rs 5 Cr, you may apply for the Service Provider category RCMC

|

| Premium service provider | If you are a service provider and your turnover is more than Rs 5 Cr, you may apply for the Premium Service Provider category RCMC

|

| Special Economic Zone (SEZ) | If your company is located in a Special economic zone and your turnover is less than Rs. 5 Cr, you may apply for SEZ category RCMC

|

Premium Special Economic Zone (SEZ)

| If your company is located in a Special economic zone and your turnover is less than Rs. 5 Cr, you may apply for Premium SEZ category RCMC

|

| Export Oriented Units (100% EOU) | If you are a 100% export oriented unit i.e. your entire production is dedicated to exports and your turnover is less than Rs 5 Cr, you may apply for EOU category RCMC |

Premium Export-Oriented Units (100% EOU)

| If you are a 100% export oriented unit i.e. your entire production is dedicated to exports and your turnover is more than Rs 5 Cr, you may apply for Premium EOU category RCMC

|

| One-Star Export House | If you have achieved an export performance with FOB/FOR value up to 3 million US dollars and you possess a one-star export house certificate, you may apply for this category RCMC |

| Two-Star Export House | If you have achieved an export performance with FOB/FOR value up to 25 million US dollars and you possess a one-star export house certificate, you may apply for this category RCMC

|

| Three-Star Export House | If you have achieved an export performance with FOB/FOR value up to 100 million US dollars and you possess a one-star export house certificate, you may apply for this category RCMC

|

| Four-Star Export House | If you have achieved an export performance with FOB/FOR value up to 500 million US dollars and you possess a one-star export house certificate, you may apply for this category RCMC

|

| Five-Star Export House | If you have achieved an export performance with FOB/FOR value up to 2000 million US dollars and you possess a one-star export house certificate, you may apply for this category RCMC

|

What documents are required for registration?

- Copy of Importer Exporter Code certificate

- Letter of authority on organization letterhead

- Factory License or MSME certificate

- Self-certificate for their Export houses as per eligibility criteria i.e. one-star export house, two-star export house, three-star export house, four-star export house, five-star export house or state export house )

What is the registration process?

A Notice has been issued by the Director General of Foreign Trade (DGFT) stating that application for a registration cum membership certificate (RCMC) or a registration certificate (RC) must be filed electronically through their common digital platform.

The procedure for registration is as follows:

Step 1: Create your account with your IEC code, and your login credentials shall be used to log in to the DGFT portal.

Step 2: After logging in, go to the e-RCMC registration section in the portal, and fill out an application form with information such as your company name, address, IEC number, PAN number, date of incorporation, and nature of the business.

Step 3: Select FIEO and Fee Details.

Step 4: Fill in the details of authorised representatives or contact persons for the councils and click on the “Add Details” button to save the details.

Step 5: Under other information, select the countries to which you will be exporting and click on save & next

Step 6: You will be required to provide supporting documents, such as a PAN card, IEC certificate, incorporation certificate, and so on (see documents required). Attach all the documents required in the attachment section.

Step 7: Once the application form is completed, review your application form, make sure not to make any mistakes to avoid rejection, and give a declaration for the submission of the form to the council.

Step 8: After that click payment for RCMC, the applicant will be directed to the payment gateway for the payment, make the payment and then click on submit.

The committee shall review the application and may request additional documents or evidence if necessary

The decision on the application shall be made within 3 months from the date of submission.

On approval of the application, you will receive an e-RCMC certificate from FIEO.

What is the fee for registration?

| Category Group | Federation Fee | Professional Fee (Chartered ONE) | GST (18%) | Total |

Multi Product Group

| 7,000

| 999 | 1,440 | 9,440 |

Premium Multi-Product Group

| 7,850

| 999 | 1,593 | 10,442 |

Service Provider

| 7,250

| 999 | 1,485 | 9,734 |

Premium Service Provider

| 8,000

| 999 | 1,620 | 10,619 |

Special Economic Zone (SEZ)

| 10,750

| 999 | 2,115 | 13,864 |

Export-Oriented Unit (100% EOU)

| 10,250

| 999 | 2,025 | 13,274 |

Premium Special Economic Zone (SEZ)

| 11,500

| 999 | 2,250 | 14,750 |

Premium Export-Oriented Unit (100% EOU)

| 11,350

| 999 | 2,223 | 14,572 |

One Star Export House

| 10,500

| 999 | 2,070 | 13,569 |

Two-Star Export House

| 14,000

| 999 | 2,700 | 17,699 |

Three-Star Export House

| 28,000

| 999 | 5,220 | 34,219 |

Four Star Export House

| 56,000

| 999 | 10,260 | 67,259 |

Five Star Export House

| 1,05,000

| 999 | 19,080 | 1,25,079 |

Benefits of registration with the Federation?

- If you are facing any export-related problem, FIEO will facilitate the redressal of your problems by taking them up with the concerned authorities.

- FIEO provides opportunities to the exporter through various channels where you can discuss online the issues on International Trade, seek clarification on policy matters, etc with FIEO experts

- Through the FIEO website, you can access updated trade policies, publications, global business opportunities, links to international trade promotion organisations etc.

- You have the option to upload your product photographs, company logo and company profile on the FIEO website to increase online visibility among potential buyers

- FIEO provides a platform for all exporters like you to create their own online store for free and enable them to extend their reach to new and existing customers globally

- FIEO organizes trade delegations, trade fairs, international exhibitions, and buyer-seller meetings to help you connect with potential international buyers and expand their market reach

- FIEO will also provide training and assistance to you in understanding export documentation and ensuring compliance with international trade regulations, making the export process smoother.

Reimbursement of Membership Fee for MSME

Reimbursement of membership fee for up to 75% of the cost paid, with a maximum limit of Rs. 20,000 or actual expenses, whichever is lower. This reimbursement is subject to quarterly reporting by Export Promotion Councils (EPCs)

To be eligible for reimbursement, the following criteria must be met for first-time registration:

a) The applicant should be registered with Micro and Small Enterprise with valid Udyam Registration. b) The applicant’s Importer Exporter Code (IEC) must not be older than 3 years on the date of the export shipment.

c) Proof of export must be provided, carried out in the same financial year for which RCMC is claimed

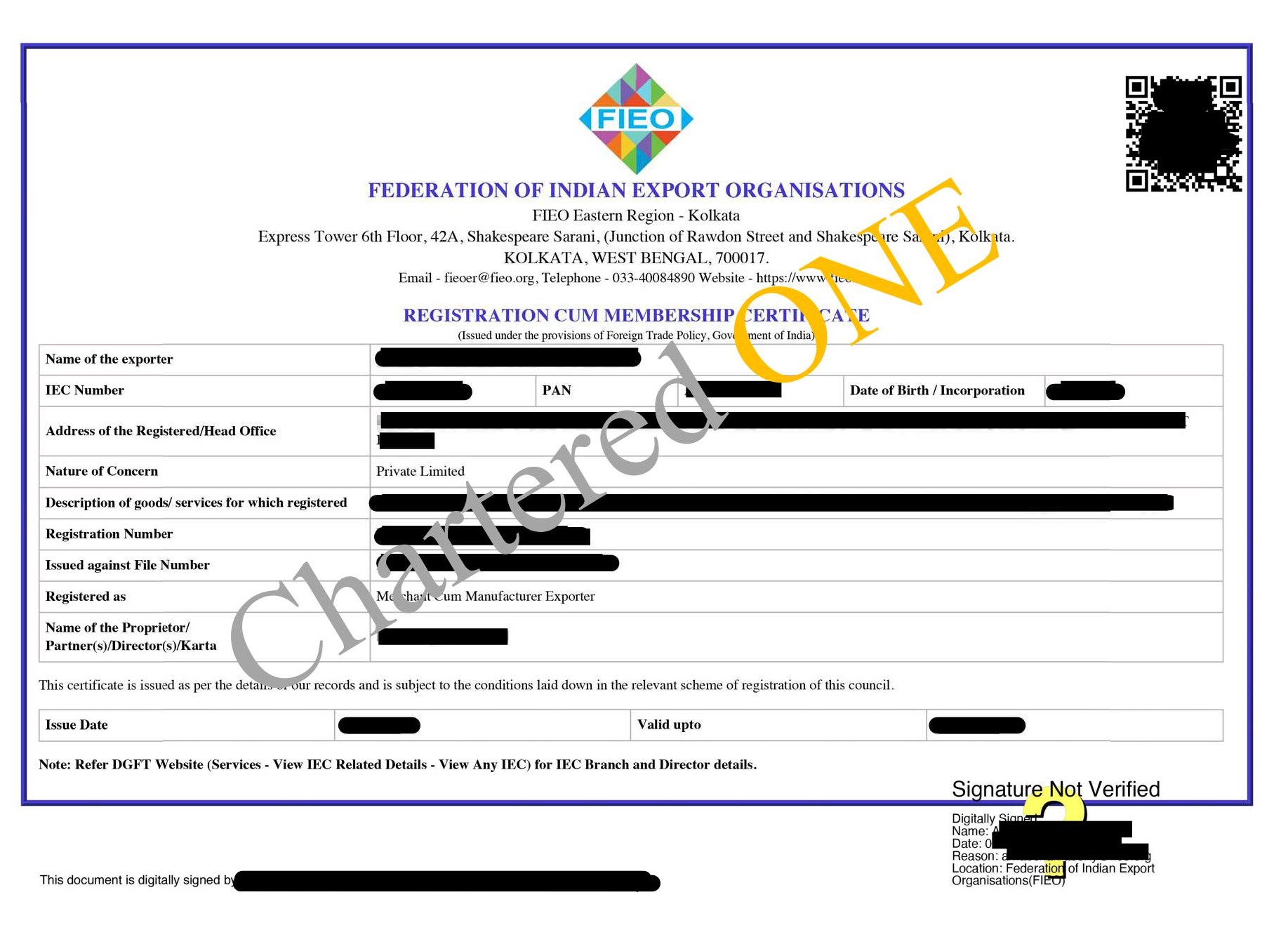

Sample Certificate

Here is the sample certificate you will receive after successful registration with the Federation