What is FCRA?

FCRA stands for Foreign Contribution Regulation Act, it is an act of parliament that was enacted in 1976 and amended in 2010. The main purpose of this act is to regulate the acceptance and utilization of foreign contributions or foreign hospitality by certain individuals, associations, or companies and to prohibit the acceptance and utilization of foreign contributions or foreign hospitality for any activities detrimental to national interest and matters connected with it.

This rule applies to all individuals, organizations, associations, groups, or NGOs that are receiving or are expecting to receive foreign donations, as per Section 1(2) of FCRA, 2010, the provisions of the act shall apply to:

- The whole of India

- Citizens of India outside India; and

- Associate Branches or subsidiaries, outside India, of companies or bodies corporate, registered or incorporated in India

What is foreign contribution?

As per Section 2(1)(h) of the Foreign Contribution (Regulation) Act (FCRA), 2010, "foreign contribution" refers to any donation, delivery, or transfer of money, goods, or securities made by a foreign source to a person or entity in India.

- Any item, unless it is a gift for someone's personal use with a market value less than the amount specified by the Central Government.

- Any form of money, whether in Indian currency or foreign currency.

- Financial instruments such as stocks, bonds, or other investments are defined under Indian law, including those defined as foreign securities.

If a person receives any money, goods, or securities from a foreign source and then transfers it to someone else, it is still considered a foreign contribution.

Interest earned from a foreign contribution deposited in any bank or any other income derived from it is also regarded as a foreign contribution.

Payments received from foreign sources for services, goods, or fees (like tuition fees paid by a foreign student to an Indian educational institution) are not considered foreign contributions.

What is a foreign source?

Foreign source, as defined in Section 2(1) (j) of FCRA, 2010 includes:-

- Any government of a foreign country or its agencies.

- Any international agency, except for the United Nations, its specialized agencies, the World Bank, the International Monetary Fund (IMF), or other agencies specified by the Indian government.

- Any company that is registered in a foreign country.

- Any corporation incorporated outside India, even if it is not classified as a foreign company.

- Any multinational corporation as defined under FCRA, 2010.

- An Indian company where more than 50% of its share capital is held by:

- A foreign government or its citizens,

- Foreign companies,

- Foreign trusts, societies, or associations. (Note: Some of these companies may not be considered a foreign source if specified by the Indian government).

- Any trade union located in a foreign country.

- Any trust or foundation set up or funded mainly by foreign countries or entities.

- Any society, club, or other associations formed or registered outside India.

- Any individual who is a citizen of a foreign country.

Who can receive foreign contribution?

Any person can receive foreign contributions, but they must meet the following conditions:

- They must have a definite cultural, economic, educational, religious, or social program.

- They must get registration or prior permission from the Central Government under the FCRA.

- They must not be on the list of people or organizations prohibited from receiving foreign contributions under Section 3 of the FCRA, 2010.

Eligibility criteria for grant of FCRA registration

For grant of registration under FCRA, 2010, the association should:

- Registered under the Indian Societies Registration Act, 1860, the Indian Trusts Act, 1882, or Section 8 of the Companies Act, 2013.

- At least 3 years of operation.

- Audited Financial Statements for 3 financial years

- Minimum expenditure of ₹10 lakhs on core activities for the benefit of the society.

Conditions to be met for the grant of FCRA Registration

To get approval for registration or permission under the Foreign Contribution (Regulation) Act (FCRA), 2010, the following conditions must be met:

- The applicant must not be fictitious or benami.

- The applicant should not been prosecuted or convicted for any religion conversion activities.

- The applicant has not been prosecuted or convicted for creating communal tension or disharmony.

- The applicant has not been found guilty of diversion or mis-utilisation of its funds.

- The applicant is not engaged or likely to engage in the propagation of sedition or advocate violent methods to achieve its ends.

- The applicant should not intend to use the foreign funds for personal benefit or other improper purposes.

- The applicant must not have violated any rules of the FCRA.

- The applicant should not be banned from receiving foreign contributions.

- If an individual, they should not have been convicted of any crime or have any ongoing criminal cases.

- If an organization, none of its directors or office bearers should have a criminal record or ongoing cases.

- the acceptance of foreign contributions by the association/ person is not likely to affect prejudicially –

- the sovereignty and integrity of India;

- the security, strategic, scientific or economic interest of the State;

- the public interest;

- freedom or fairness of election to any Legislature;

- friendly relation with any foreign State;

- harmony between religious, racial, social, linguistic, regional groups, castes or communities.

- the acceptance of foreign contribution-

- shall not lead to incitement of an offence;

- shall not endanger the life or physical safety of any person

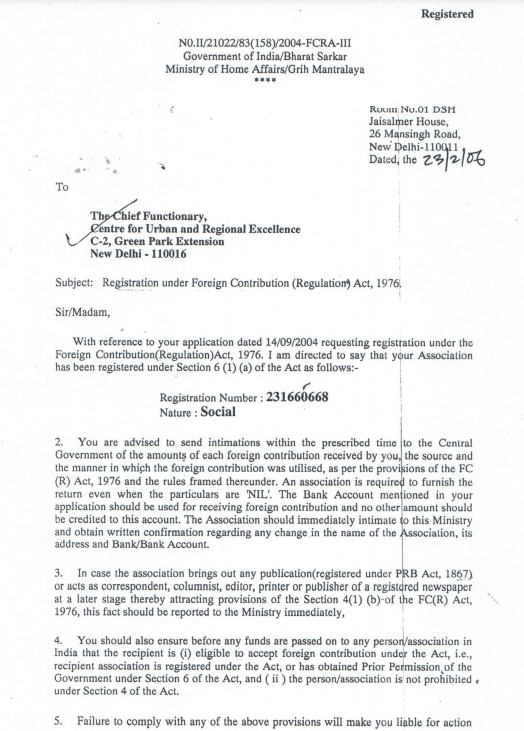

Sample FCRA Registration certificate

On successful submission and approval of your FCRA license application, This is the certificate you will receive.