About Authorized Dealer Code

Authorized Dealer code or AD code is a 7-digit unique code provided by the bank of the importer or exporter, through which they are expected to conduct their foreign exchange transaction. It is a unique code allotted to the traders involved in foreign currency transactions in India

To obtain AD code every import-export trader is required to link the AD code to the import-export code (IEC) through the ICEGATE portal for seamless customs clearance of cargo.

To start the import or export of cargo, every IEC holder is required to register for an AD code linking their bank account number provided by an authorized dealer bank branch at multiple port locations.

The facility to register and modify bank account details can be done online through the ICEGATE platform. For each port location where the IEC holder conducts import and export activities, they can have only one bank account registered with the AD code.

Importance of AD Code Registration

Custom clearance of cargo: Registered AD code ensures smooth customs clearance of cargo, without a registered AD code, the trader will not be able to generate a shipping bill which is an important document for cargo to pass through customs.

Track foreign currency transactions: The AD code is also used by RBI to track and monitor foreign currency transactions. It helps RBI to ensure that the transaction complies with the foreign exchange regulation

Payment process: AD code is essential for exporters and importers to receive and make foreign currency payments. AD Code is essential for exporters to receive payments from overseas buyers, while importers require the AD code to make payments to foreign suppliers.

Drawback refund claims: Drawback refund claims are expected to be processed by the authority only if the bank account details are registered with AD code. This means that only those who have a registered authorized dealer (AD) code are eligible to apply for drawback refunds.

Easily claim government schemes: AD code registration enables direct deposits of government benefits, incentives, or subsidies into the exporter’s bank account without any restrictions.

Who can register for AD Code ?

Both regular registered users holding a valid digital signature and simplified registered users having a valid IEC can register bank account details online using the ICEGATE portal.

Regular registered users: These users hold a valid digital signature (Class-3 category) and can register their bank account online. They need to sign the documentary proofs using their DSC and upload them to e-SANCHIT, providing the IRN (internal reference number) received after uploading.

Simplified registered Users: These users do not have a digital signature; they can also register online upon entering the valid IRN number of the documents he has uploaded in e-SANCHIT and the ‘Uploading ICEGATE ID’, which is the ICEGATE ID of the registered user whose digital signature has been used to sign the uploaded documents.

What are the documents required for registration?

Document required to be uploaded on e-Sanchit portal for AD Code registration

The following legible scanned documents are required to be uploaded in e-Sanchit for new registration of AD Code with Bank Account for foreign remittance:

- Bank authorization letter in format attached as Annexure-A (Refer to Public Notice No.93/2020)

- Copy of IEC

- Copy of GST Registration Certificate

- Copy of PAN Card of the Company/Partnership Entity

- Copy of PAN Card of Authorised Signatory (Director/Partner/Proprietor) in Bank Account

- Copy of cancelled cheque

- Documents required to be prepared before proceeding to add/update a Bank account in ICEGATE

- Photo Passbook of Running Bank Account

- Bank Letter or Certificate for A/C Holder

What is the registration process?

Step 1: Login at ICEGATE: Login into ICEGATE with ICEGATE Login ID and password

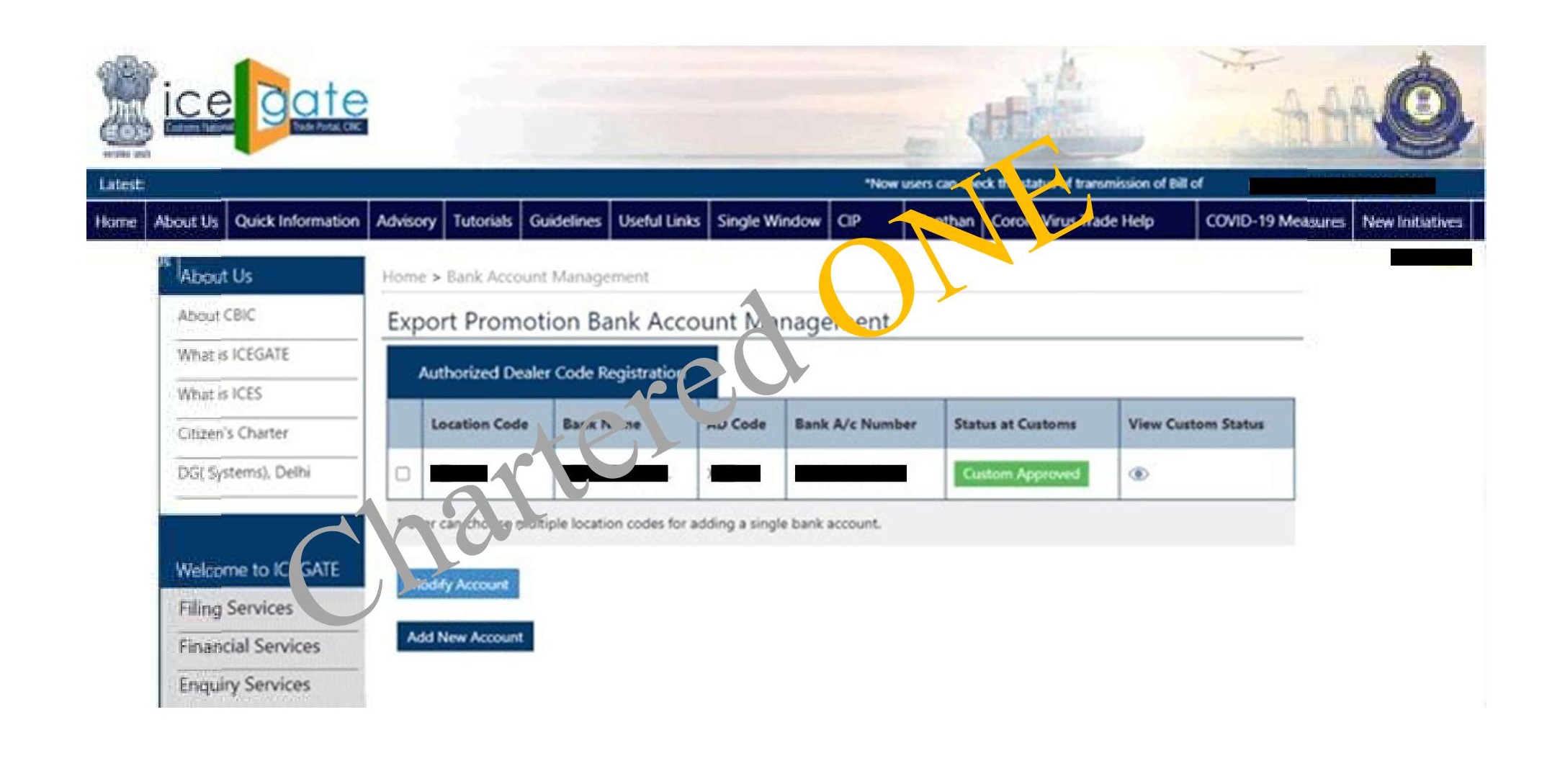

Step 2: On the left panel click on Bank Account Management, Export Promotion Bank Account Management page appears

Step 3: On the Export Promotion Bank Account Management page, the user gets two options in the dropdown

- Bank A/c for Export Promotion Incentive and

- Authorized Dealer Code Registration

Select the Authorized Dealer Code Registration and click on Submit to view the dashboard for AD Code Bank Account Registration.

Note: Ensure that guidelines under Section B.1. in case Location code(s) are not visible or the dashboard appears empty with the error “No location added for the user”

Step 4: Select “Add New Account” option at the bottom of the Dashboard next to “Modify Account” option, only if an account is not registered for any of his registered locations previously. If the user has already added a bank account for any of his registered locations, he won’t be able to request for bank account addition for other locations.

- Fill in the form

- Enter the bank name.

- Select the location from the dropdown. It contains only those locations on which the user is registered and he has not added any bank account for the same.

- Enter the valid AD code of the Bank Branch. This code can also be fetched from the AD Code Help Enquiry available on the left panel of the post login page shown to a registered user

- Enter the valid IRN number of the documents he has uploaded in e-SANCHIT

- Enter the uploading ICEGATE ID number

- Once the user enters all valid inputs and clicks on Save Change, a six-digit OTP is sent to the user’s email ID and mobile number

- On Verification, a request for bank account modification is submitted to ICEGATE.

Application may take 3-5 working days for processing.

Step 5: On approval, the bank account details will start reflecting on the authorised dealer code dashboard.

NOTE: On submission of the bank account details in the ICEGATE platform, the status reflecting on the authorised dealer code dashboard can be as follows:

- System Pending - The request is pending verification at a system level.

- System Rejected - The request has an error at a system level

- Custom port Approved - The request has no error and Custom port has approved the request. The bank account will be reflected on the dashboard once the request is Custom port approved.

- Custom port Rejected - The request has been rejected by Custom port officers

- Custom port Pending - The request has no system-level error and the request is pending with the Custom port officer.

What is the fee for registration?

| Particulars | Amount |

| Government Registration Fee | 2,999 |

| Professional Fee (Chartered ONE) | 999 |

| GST (18%) | 720 |

| Total | 4,718 |

Sample Document

Upon Successful registration of the AD Code, your ICEGATE dashboard will show approved at customs.