About Importer Exporter Code

Importer Exporter Code (IEC) is a ten-digit unique code that will be assigned to you or your company by the Director General of Foreign Trade (DGFT) and is a mandatory requirement if you want to engage in any kind of import or export of goods in India regardless of the value of the trade.

The IEC is unique to each business entity and once you have obtained an IEC for your business it is valid for a lifetime and is non-transferable

You will also need to renew the Importer Exporter Code every year, it is mandatory now for IEC License holders. Once the import export code is issued, you can apply for port registration on the ICEGATE portal with the help of AD Code registration.

However, IEC is not necessary to be obtained if you are engaged in the export of services except when you as a service provider are taking benefits under the Foreign Trade Policy.

Why are you required to renew IEC?

Under the 12th February, 58th Notification by DGFT, certain amendment clauses were introduced for the Importer and Exporter Code (IEC):

- The DGFT recently notified that an IEC holder must ensure that the details provided in the certificate are updated every year even if there are no changes in the IEC, it must be renewed and confirmed online every year.

- IEC has now been recognized as e-IEC

- IEC holders must electronically update their IEC details every year. Even if there are no changes in IEC, the holder must confirm this status online. This annual update and confirmation process is a necessary compliance requirement for IEC holders.

- IEC can be deactivated if it is not updated within the specified timeframe. However, it can be reactivated upon successful updating.

- Furthermore, an IEC may be flagged for scrutiny, and it's the responsibility of the IEC holder(s) to promptly address any flagged risks. Failure to do so will result in deactivation.

It is worth noting that this deactivation does not affect any other actions taken for violating other Foreign Trade Policy (FTP) provisions

Documents required for renewal?

- copy of business PAN

- copy of incorporation or registration certificate.

- copy of address proof of the applicant’s entity – (Sale Deed, rent agreement, lease deed, electricity bill, telephone landline bill, mobile, post-paid bill, MoU, Partnership deed)

- In case the address proof is not in the name of the applicant firm, a no objection certificate (NOC) from the owner of the firm’s premises

- Bank account details & bank certificate along with a cancelled cheque

- DSC of the organisation

What is the process of renewal?

You do not need to worry about the registration process, we will do it for you for Free

However, if you want to do it yourself, Here are the steps that can help:

Step 1: Login using your credentials. Click on Link IEC. Once you have linked your IEC, a new pop-up window opens asking for digital signature requests. For this, you are required to authenticate either by Digital Signature Certificate or Aadhar-based OTP.

Step 2: Once you have been linked by authentication, you can renew or update other information on your IEC. Choose the "Update/Modify IEC" option.

Step 3: In the pre-filled application form, if there are any changes in your business details then you can make such changes

However, the PAN details, nature of the concern, and GSTN are permanent for an IEC and cannot be changed.

The following details can be modified:

- Firm Name

- Firm Address details, you will also be required to attach the proof of the updated address as listed in the document required section

- “Whether the firm is located in the Special Economic Zone (SEZ)?” & “Whether the firm is located in the Export Oriented Unit (EOU) Scheme, Electronic Hardware Technology Park (EHTP) Scheme, Software Technology Park (STP) Scheme or Bio-Technology Park (BTP) scheme)?”

- Details of the Director/Partner/Proprietor/Karta/Managing trustee (As applicable)

- Bank Account section, Account Number, Account Holder Name, IFSC code, Bank Name, and Branch Name and attach proof of updated bank account (Cancelled Bank Cheque / Bank certificate).

- “Other Details (Exports Sectors preferred)” section. Modify the reason and answer the question “Why you are applying for IEC or where this IEC will be utilized”

Step 4: Give your declaration, check the application summary and click on the sign button to sign the application using your DSC or Aadhaar-based OTP.

Step 5: Once approved and renewed, you will receive the IEC certificate in the email and you can download and print the IEC from the DGFT website.

Key scenarios where you will require an IEC number?

The main purpose of the IEC is to track and monitor your imports and exports and to ensure that they comply with the country's foreign trade policy.

An IEC is mandatory if you wish to import or export goods in India, and is required to be quoted in all shipping documents.

Here are some examples:

- Custom Clearance: If you are importing or exporting goods, an IEC is required for customs clearance documents such as the bill of entry for imports and the shipping bill for exports.

- Commercial Invoice: The IEC number is included on the commercial invoices issued by an exporter to the importer to identify parties involved in international trade transactions.

- Banking Transaction: Banks require IEC for processing international trade-related transactions both receiving foreign currency and making any payments abroad.

- Letter of credit: Banks also require IEC for processing letters of credit and other trade finance instruments.

- Export Promotion Council Registration: Registration with export promotion councils and boards, which provide export-related benefits and support, also requires an IEC.

- Custom Bonds and Guarantees: IEC is needed for executing various custom bonds and guarantees to execute various trade facilitation schemes.

- Having an IEC also allows an importer or exporter to avail of various benefits and incentives by the government for promoting trade. Besides, government tenders that involve international trade require an IEC.

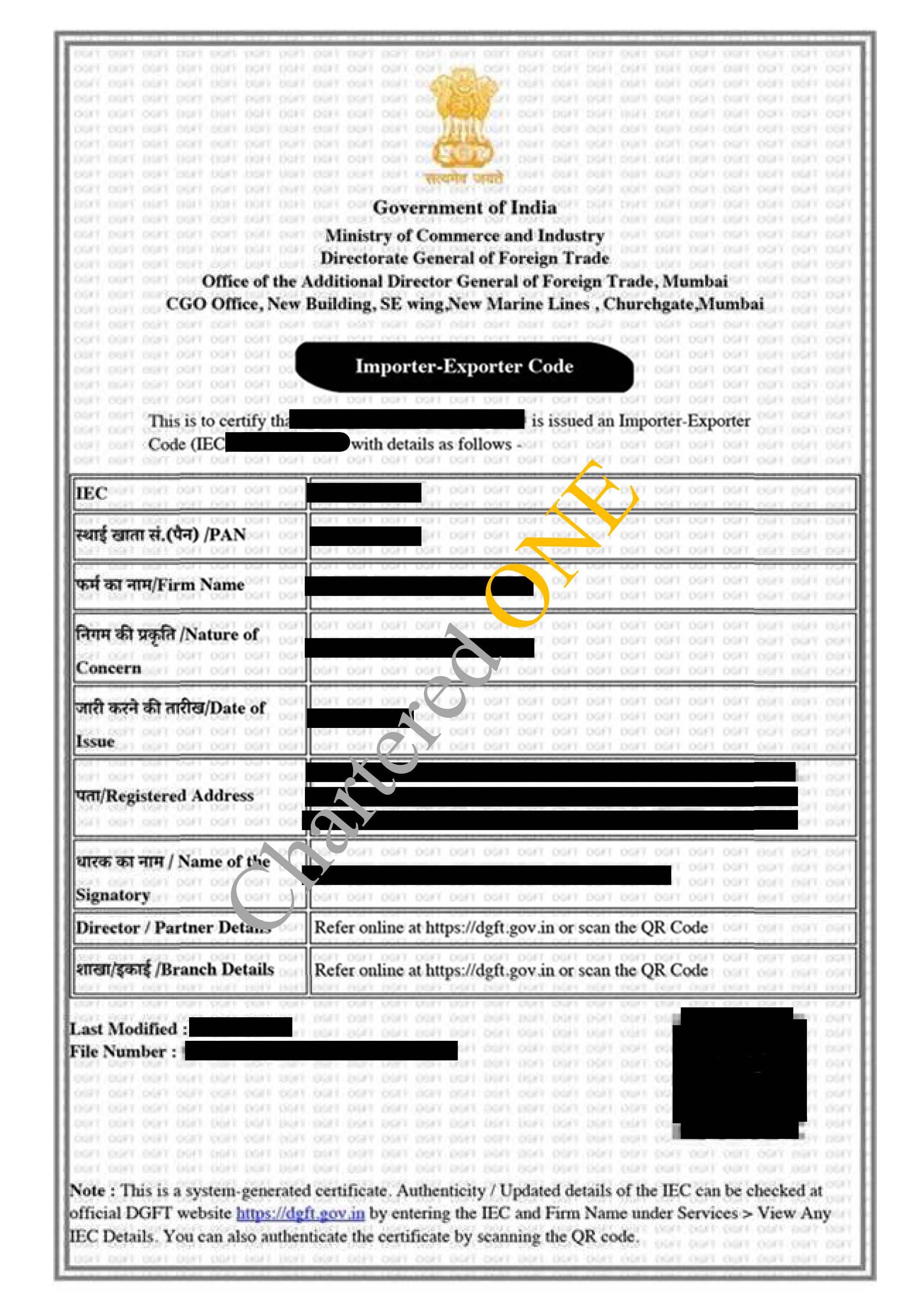

Sample Certificate

Here is the updated IEC certificate you will receive upon successful renewal.