About Importer Exporter Code

Import Export Code (IEC) is a ten-digit unique code that will be assigned to you or your company by the Director General of Foreign Trade (DGFT) and is a mandatory requirement if you want to engage in any kind of import or export of goods in India regardless of the value of the trade. The IEC serves as proof of your entity's registration with the DGFT and is required for customs clearance and to avail of various benefits and schemes offered by the government.

The IEC is unique to each business entity and once you have obtained an IEC for your business it is valid for a lifetime and is non-transferable

You will also need to renew the Importer Exporter Code every year, it is mandatory now for IEC License holders. Once the import export code is issued, you can apply for port registration on the ICEGATE portal with the help of AD Code registration.

However, IEC is not necessary to be obtained if you are engaged in the export of services except when you as a service provider are taking benefits under the Foreign Trade Policy.

Key scenarios where you will require an IEC number?

The main purpose of the IEC is to track and monitor your imports and exports and to ensure that they comply with the country's foreign trade policy.

An IEC is mandatory if you wish to import or export goods in India, and is required to be quoted in all shipping documents.

Here are some examples:

Custom Clearance: If you are importing or exporting goods, an IEC is required for customs clearance documents such as the bill of entry for imports and the shipping bill for exports.

Commercial Invoice: The IEC number is included on the commercial invoices issued by an exporter to the importer to identify parties involved in international trade transactions.

Banking Transaction: Banks require IEC for processing international trade-related transactions both receiving foreign currency and making any payments abroad.

Letter of credit: Banks also require IEC for processing letters of credit and other trade finance instruments.

Export Promotion Council Registration: Registration with export promotion councils and boards, which provide export-related benefits and support, also requires an IEC.

Custom Bonds and Guarantees: IEC is needed for executing various custom bonds and guarantees to execute various trade facilitation schemes.

Having an IEC also allows an importer or exporter to avail of various benefits and incentives by the government for promoting trade. Besides, government tenders that involve international trade require an IEC.

who is required to obtain IEC?

Every registered business including proprietorship, partnership, LLP, Limited companies, HUF, trusts and societies require an IEC if they import or export for commercial purpose

Although the following categories of person have been exempted from obtaining Importer Exporter Code

Ministries or Departments of Central or State Government.

Persons are importing or exporting goods for personal use unrelated to trade, manufacturing, or agriculture.

Persons importing or exporting goods from or to Nepal, Myanmar through Indo-Myanmar border areas and China, provided the CIF value of a single consignment does not exceed Rs.25,000. In the case of Nathula port, the applicable exemption ceiling is Rs.1 lakh.

Exemption from obtaining IE code is not applicable in exporting special chemicals, organisms, materials, equipment, and technologies listed in Appendix 3 of Schedule 2 of ITC HS.

What are the documents required for registration?

copy of Utility bill (not more than 3 months old)

copy of business PAN

copy of incorporation or registration certificate.

Address Proof of the applicant’s entity – (Sale Deed, rent agreement, lease deed, electricity bill, telephone landline bill, mobile, post-paid bill, MoU, Partnership deed)

In case the address proof is not in the name of the applicant firm, a no objection certificate (NOC) by the owner of the firm’s premises

Bank account details & bank certificate along with a cancelled cheque

DSC of the organisation

Other acceptable documents (for proprietorship only): Aadhar card, passport, voter ID

After applying, DGFT will issue an IEC within 15 days from the date of application

Once the IEC is issued, the business entity must inform the DGFT of any changes to the information provided in the application, such as changes to the business address or the authorized representative.

What is the registration process?

You can apply for Importer Exporter Code (IEC) online through the DGFT (Directorate General of Foreign Trade) website. Here is an overview of the process:

Go to the DGFT website and create an account using your email and mobile number.

Once you have logged in, click on the "Apply for IEC" button.

Click on the “Start Fresh Application” button or click on the “Proceed with Existing Application “Button in case you have already saved a draft application.

Fill out the application form

Select the nature of the Concern/Firm.

Enter Firm Name

PAN, Name (As per PAN Database) and Date of Birth/ Date of Incorporation

Firm Address details, you will also be required to attach the address proof as listed in the Document required section

Select “Whether the firm is located in the Special Economic Zone (SEZ)?” & “Whether the firm is located in the Export Oriented Unit (EOU) Scheme, Electronic Hardware Technology Park (EHTP) Scheme, Software Technology Park (STP) Scheme or Bio-Technology Park (BTP) scheme)?”

Enter the GSTIN Number of the firm/concern (If applicable)

Enter the Details of the Director/Partner/Proprietor/Karta/Managing trustee (As applicable)

Under the Bank Account section, enter the Account Number, Account Holder Name, IFSC code, Bank Name, and Branch Name and attach proof (Cancelled Bank Cheque / Bank certificate).

Enter the details in the “Other Details (Exports Sectors preferred)” section. Select the reason and answer the question “Why you are applying for IEC or where this IEC will be utilized”

Give your declaration, check the Application Summary and click on the Sign button to sign the application using your DSC or Aadhaar-based OTP.

Confirm and proceed to make the payment against the application

After Successful Payment the Page shall be redirected to the DGFT Website and the receipt shall be displayed, you can also download the receipt.

Once the application is approved, you will receive your IEC via email or post.

It's worth noting that before applying for IEC the business should be registered with the Ministry of Corporate Affairs (MCA) or Registrar of Companies (ROC) and should have a PAN card.

What is the fee for registration?

| Particulars | Amount |

| Government Fee | 500 |

| Professional Fee (Chartered ONE) | 499 |

| Total | 999 |

Benefits of using Importer Exporter Code (IEC)

Facilitation of import and export procedures: IEC is required for all documents related to imports and exports, such as shipping bills, bill of lading, and import-export declarations. Having an IEC ensures that all of these documents are processed smoothly and efficiently.

Eligibility for various benefits: Importers and exporters with an IEC are eligible for various benefits, such as duty-free imports and exports, export promotion schemes, and trade agreements.

Compliance with government regulations: IEC is mandatory for businesses engaging in international trade, and failure to obtain one can result in penalties. Having an IEC demonstrates that the business is compliant with government regulations.

Reputation and credibility: Obtaining an IEC is a sign that a business is legitimate and operating in compliance with the laws and regulations. This can help build the reputation and credibility of the business, particularly among foreign clients and partners

Business expansion: Having an IEC allows a business to expand into international markets, which can help increase revenue and growth potential.

Access to trade financing: Some of the trade financing institutions in India require an IEC for funding, so having an IEC can give a business access to additional financing options.

What are the functions of IEC?

Identifying importers and exporters: The IEC serves as a unique identification number for businesses engaged in international trade. It helps government agencies and other stakeholders to identify and track the activities of these businesses.

Facilitating trade: The IEC is required for businesses to complete various procedures and formalities related to import and export, such as obtaining a shipping bill, making electronic declarations, and claiming various benefits and incentives.

Compliance with regulations: Businesses with an IEC are required to comply with various regulations related to international trade, such as foreign exchange management laws and customs rules. The IEC is also used to monitor compliance with these regulations.

Obtaining benefits and incentives: Businesses with an IEC are eligible for various benefits and incentives offered by the government to promote exports, such as duty-free imports of certain goods, export promotion schemes, and reimbursement of taxes and duties.

Enhancing transparency: The use of IECs helps to increase transparency in international trade by providing a clear picture of trade flows and enabling the government to track the movement of goods across borders.

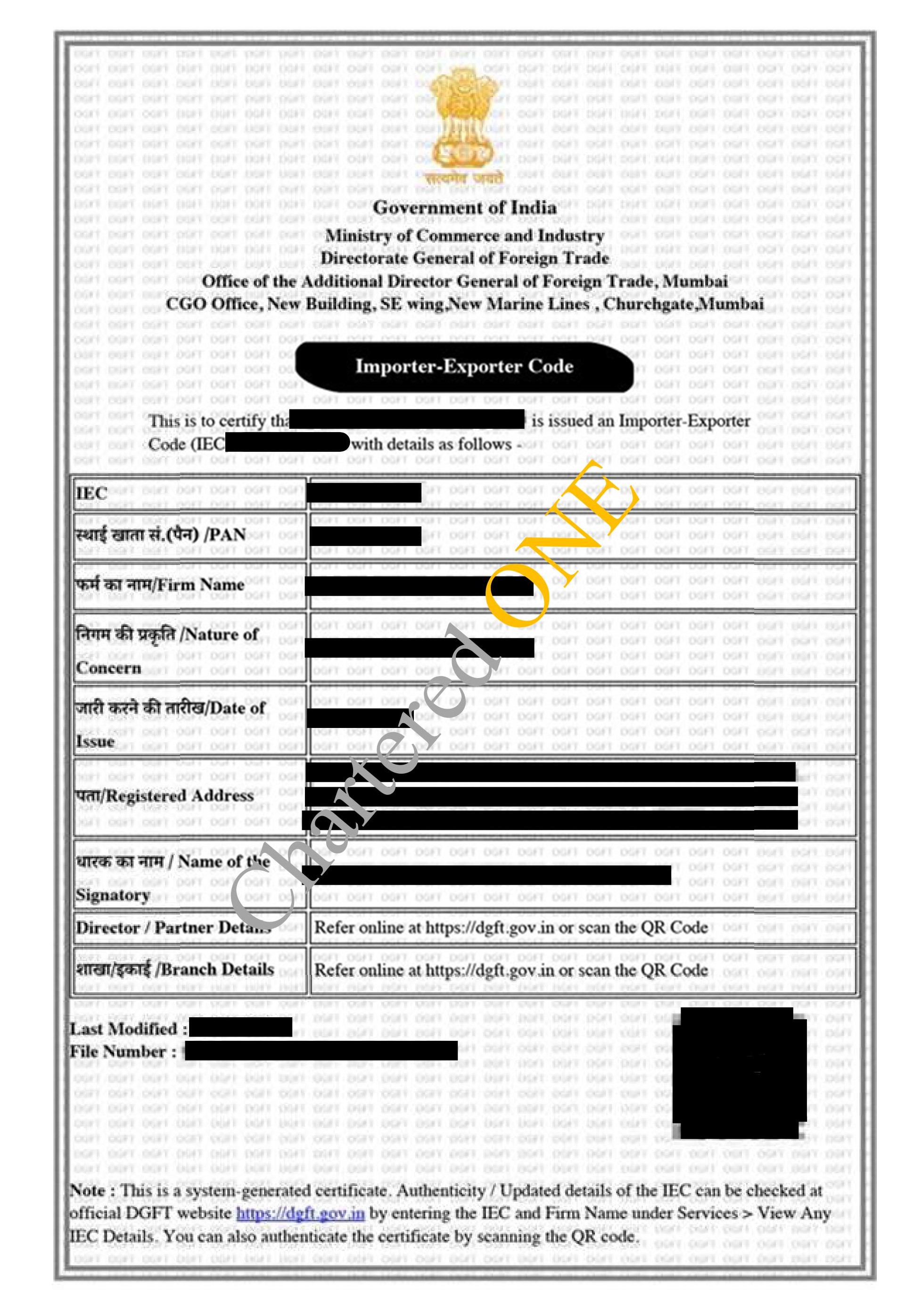

Sample Certificate

Here is the sample IEC certificate you will receive upon successful registration, within 15 days from the date of application