PvtLtd Registration for company

This Company is the most prevalent & popular type of corporate legal entity in India. A PvtLtd Co is a privately held business entity and Company is privately held by the shareholders

This Company is the most prevalent & popular type of corporate legal entity in India. A PvtLtd Co is a privately held business entity and Company is privately held by the shareholders

The above mentioned professional fees is for 2 members with Authorised Share Capital of Rs 1,00,000.

Instant Drafting, filing & Consultation with CA/CS

Instant Drafting, filing & Consultation with CA/CS

DSC for Shareholders & Directors

DSC for Shareholders & Directors

4 Name reservation choices & Instant filing in 24hrs

4 Name reservation choices & Instant filing in 24hrs

MOA & AOA Instant Drafting in 24hrs

MOA & AOA Instant Drafting in 24hrs

SPICe+ form Instant filing in 24hrs

SPICe+ form Instant filing in 24hrs

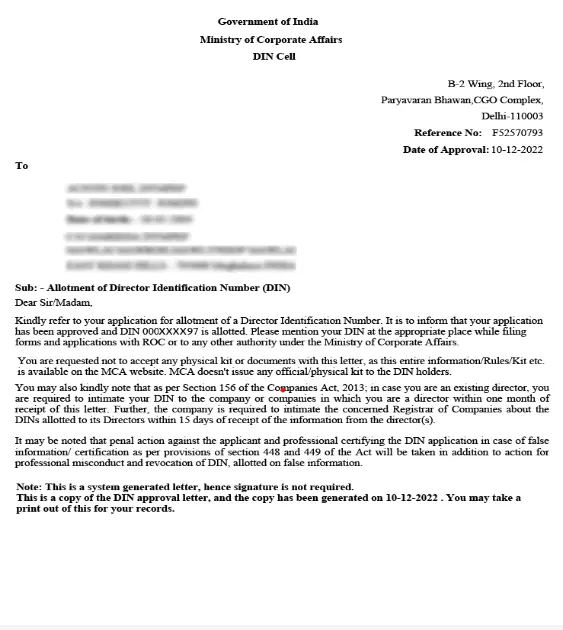

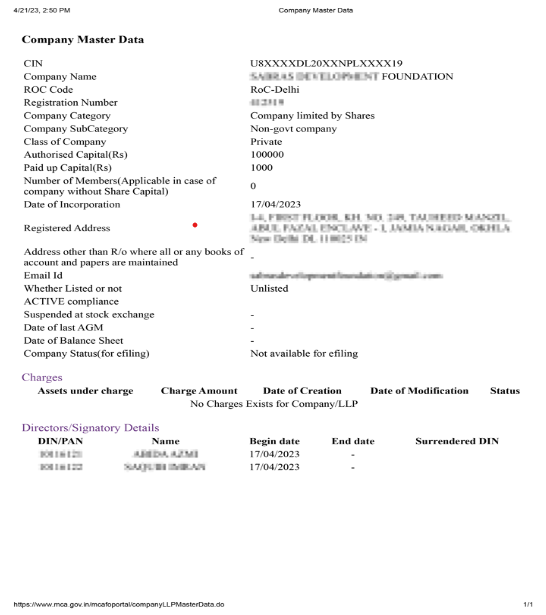

Allotment of CIN & 2 DINs in 7 days

Allotment of CIN & 2 DINs in 7 days

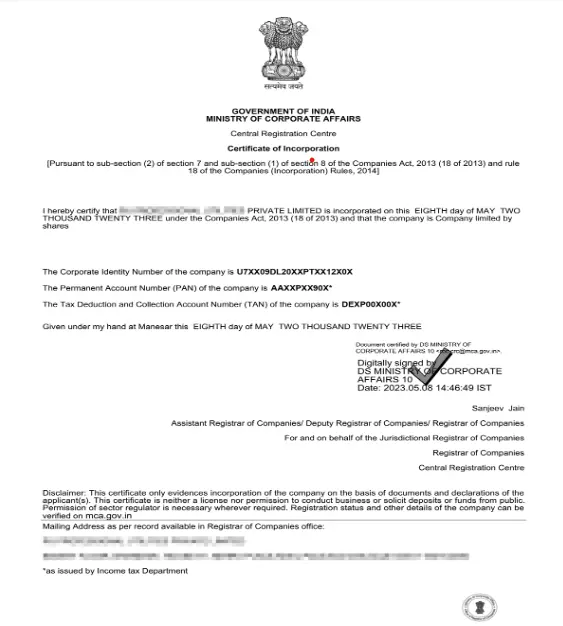

Incorporation certificate in 7 days

Incorporation certificate in 7 days

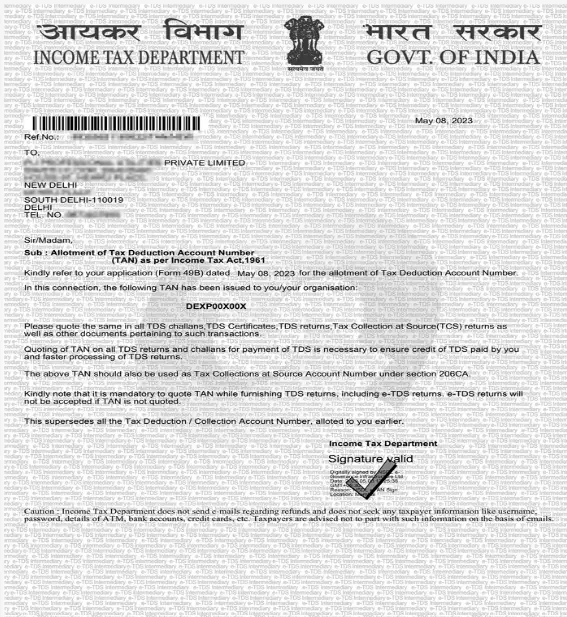

PAN, TAN, ESI & PF Registration in 7 days

PAN, TAN, ESI & PF Registration in 7 days

Free Bank Account opening

Free Bank Account opening

Ensure your new PvtLtd Co is fully compliant with MCA regulations through expert CA & CS review.

Instant INC 20A filing (Commencement of Business)

Instant INC 20A filing (Commencement of Business)

Instant ADT-1 filing (Appointment of Auditor)

Instant ADT-1 filing (Appointment of Auditor)

Issuance of Share certificate by CS

Issuance of Share certificate by CS

GST Registration in 24hrs

GST Registration in 24hrs

Consent Letter drafting by CS

Consent Letter drafting by CS

Board Resolution Drafting by CS

Board Resolution Drafting by CS

GST Filing for 2 months by CA

GST Filing for 2 months by CA

We will take care of all your complainces so that you don't need to worry.

MCA annual return filing and DIR-3 Director KYC

MCA annual return filing and DIR-3 Director KYC

Dedicated CS for ROC Compliance for 1 year

Dedicated CS for ROC Compliance for 1 year

Facilitation of Annual General Meeting

Facilitation of Annual General Meeting

GST, TDS, ESI, PF filing for 6 months

GST, TDS, ESI, PF filing for 6 months

Financial Statement preparation

Financial Statement preparation

Accounting & Bookeeping by CA for 1 years

Accounting & Bookeeping by CA for 1 years

Income Tax Return filing

Income Tax Return filing

We will take care of all your complainces so that you don't need to worry.

One TradeMark Registration

One TradeMark Registration

Dedicated CS for ROC compliances for 2 years

Dedicated CS for ROC compliances for 2 years

Accounting & Bookeeping by CA for 1 year

Accounting & Bookeeping by CA for 1 year

GST, TDS, PF, ESI filing for 1 year

GST, TDS, PF, ESI filing for 1 year

Income Tax Return 2 years

Income Tax Return 2 years

Satisfaction guaranteed or get your money-back Learn more.

Start your Company in 3 easy steps. No time wasted.

Once you are on board. We will ensure you get full satisfaction. 24/7 customer support.

No surprises. We guarantee there are no hidden fees

Over 10,000 businesses have trusted us to handle their registration and compliance needs, ensuring they operate smoothly and in accordance with Indian laws and regulations. For over six years, we’ve been committed to making the process of starting and managing a business straightforward and transparent. Your trust is our top priority.

Our platform is built and maintained by a team of Chartered Accountants and compliance experts, combining the latest technology with our extensive knowledge of Indian business regulations. Every day, we help businesses register, file taxes, and maintain compliance with local and national laws.

We understand the frustration of dealing with legal paperwork and complex regulatory requirements, and we’re dedicated to providing accurate and reliable services. We ensure your business stays compliant with the latest laws, so you can focus on growing your business. We are fully transparent about our services and fees, making sure you know exactly how we help and what you’re paying for.

We put significant effort into keeping our platform updated with the latest regulations. Our team regularly reviews and verifies compliance updates, and we rely on feedback from clients like you to continuously improve our services.

If you notice anything that isn’t right, you can report the issue to us, and we’ll address it promptly.

A Private (PvtLtd) is a type of business entity you can register that is recognized under the Companies Act 2013. The primary objective of a Pvt Co is to limit the owner's personal liability of its owners. This means that the shareholders are only liable for the amount they have invested in the company and are not personally responsible for its debts or obligations.

A Private Co isn't always required. Still, many small business owners choose to incorporate a Pvt Co to protect their personal assets if the company faces financial difficulties or legal issues. Having a Pvt Co can also help you to get DPIIT startup recognition, get tax benefits, enter into contracts, get funding, and get necessary government and permits.

When you incorporate a Private Co, you submit the SPICe+ form to the Ministry of Corporate Affairs, along with SPICe e-MOA, e-AOA & CA/CS/Lawyer declaration. Once it's approved, you can use this separate entity to record business expenses, take on business debts, file taxes, obtain businesslicense, and more—and this is what gives you liability protection.

You may be slightly intimidated by the idea of forming a legal entity like a Limited Co, especially if it's your first time. All you need is an understanding of what your business will do, how you plan to run it, a unique name for your business, and an address for registration which can be your home address also.

We will prepare all the documents you need for Co. Registration. We will:

File for Name approval.

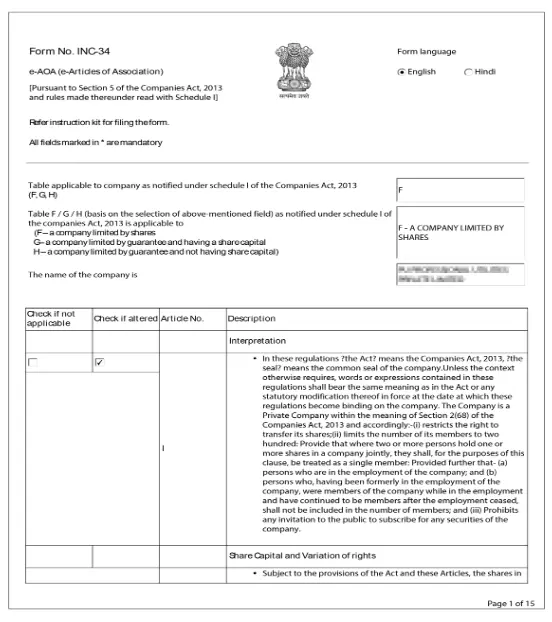

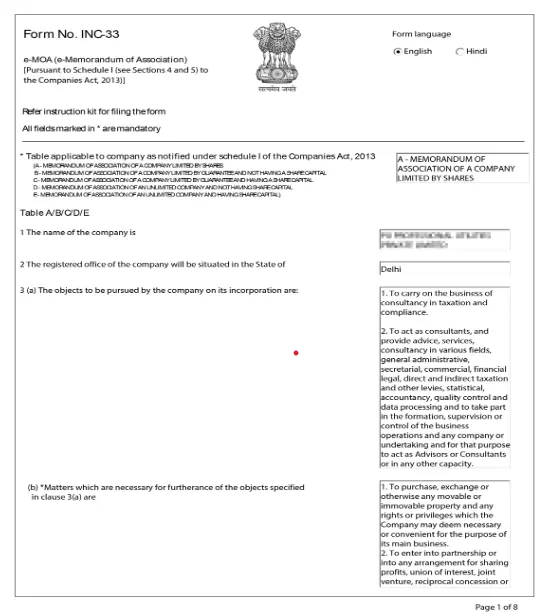

Draft MOA and AOA for your company.

Give Chartered Accountant declaration for your company incorporation.

File for approval with Ministry of Corporate Affairs.

Select the perfect plan that fits your needs and budget. Compare features and benefits to find your ideal option.

You will get your personalised dashboard where you can track progress & get in touch with our team.

Pay for services rendered, our pricing is transparent with no hidden costs. If you are unsatisfied, we will get you a refund

Upload your documents securely and efficiently through our easy-to-use platform.

Sit Back & relax, we will register your company effortlessly with our streamlined process.

The procedure of incorporating a Pvt Co in India involves the following steps:

As per guidelines, all applicatons to the Registrar of Companies are filed in digital format and are therefore required to be authentcated using a digital signature of the authorized signatory. Proposed directors must acquire a Class 2 or Class 3 DSC for digital signing of incorporaton documents. Chartered ONE offers Digital Signature service, fulfilling this requirement of obtaining a DSC for ROC fillings.

The next step is that you'll need to submit a SPICe RUN form, which is part of the larger SPICe+ form. Chartered ONE ensures you secure your dream company name during an inital availability check. However, if your preferred name is already registered, we provide unlimited alternatve company name searches to help you find the perfect fit.

Applicaton for Incorporaton is draŌed using SPICe+ form, a simplified proforma for incorporatng the company electronically, along with SPICe e-MOA & e-AOA. Chartered ONE makes your company incorporaton easy and simple.

Upon successful verificaton by the ROC, you will receive Director Identification number, Certificate of Incorporaton, a PAN card, and a TAN card

Upon obtaining PAN, Company will be eligible to open a current bank account. Chartered ONE offers multple banks to choose from, with the process being entirely remote & streamlining the experience for you.

Upon successful opening of the Bank account, the Share holders of the company is requried obtain share certificate from the Company.

ESI registraton is required when the employee count is 9 and EPF registraton is required when the employee count is 20. Voluntary registraton opton is also available even if below threshold limit. Professional Tax is applicable in some states based on the earnings of the employee. Ensure a smooth ESI, EPF, PT registraton for your Company with Chartered ONE's expert guidance.

There are several important differences between a Pvt and Sole Proprietorship:

Pvt Co

Pvt Co have shareholders, and their shares are privately held, meaning they cannot be traded on public stock exchanges. have shareholders, and their shares are privately held, meaning they cannot be traded on public stock exchanges.

A Pvt Co are often seen as more credible, which can make it easier to do business with other companies.

A Pvt Co is a seperate legal entity. It can sue or be sued for its property & enter into legally binding contracts.

Companies Act, 2013 makes it mandatory for Pvt Co to maintain their books of account at the registered office.

A PvtlimitedCo can raise capital by issuing shares to investors, venture capitalists, or angel investors easily.

Sole Proprietorship

A sole proprietorship is owned and operated by a single individual. It is not a seperate entity & does not have a seperate business PAN.

Appears less formal and professional due to its simple structure. It often operates under the owner's name or a trade name.

It is not a seperate legal entity from the owner. If the business is sued or cannot pay its debts, the owner's assets can be used to pay the debts.

Companies Act, 2013 makes it mandatory for Pvt Co to maintain their books of account at the registered office.

Investors cannot invest in sole proprietorship firm. Primarily reliant on personal savings, loans (secured against personal assets), or credit cards.

There are several important differences between a Pvt Co and a Partnership Firm:

Pvt Co

Pvtcompany have shareholders, and their shares are privately held, meaning they cannot be traded on public stock exchanges.

A Privatelimited are often seen as more credible, which can make it easier to do business with other companies.

A Privatelimited is a seperate legal entity. It can sue or be sued for its property & enter into legally binding contracts.

Companies Act, 2013 makes it mandatory for PvtlimitedCo to maintain their books of account at the registered office.

A Privatelimited can raise capital by issuing shares to investors, venture capitalists, or angel investors easily.

Partnership firm

Owned by two or more individuals, known as partners, who share profits and losses of the business in a predetermined ratio as specified in the deed.

While generally less formal than a Privatelimited, a partnership can appear more official than a sole proprietorship, especially with multiple owners.

Not a separate legal entity and partners have unlimited liability. If the firm is sued or cannot pay its debts, the partners's assets can be used to pay the debts.

Exempt from mandatory book-keeping unless their income exceeds the prescribed threshold for tax audits under Section 44AB of the Income Tax Act.

Investors cannot invest in a partnership firm unless they become partner of the firm. Primarily relies on personal capital & advances, loans, Cash Credits, etc.

There are several important differences between PvtlimitedCo and a one person company:

PvtlimitedCo

PvtlimitedCo Co have shareholders, and their shares are privately held, meaning they cannot be traded on public stock exchanges.

A PvtlimitedCo are often seen as more credible, which can make it easier to do business with other companies.

A PvtlimitedCo is a seperate legal entity. It can sue or be sued for its property & enter into legally binding contracts.

Companies Act, 2013 makes it mandatory for PvtlimitedCo to maintain their books of account at the registered office.

A PvtlimitedCo can raise capital by issuing shares to investors, venture capitalists, or angel investors easily.

One person company

An OPC is owned and controlled by a single person, who is both the shareholder and director.

OPC offers a formal business structure, lending credibility and trust. which can make it easier to do business with other companies.

An OPC is a separate legal entity, distinct from its owner. It enjoys the same legal rights and obligations as a company.

Companies Act, 2013 makes it mandatory for one person companies to maintain their books of account at the registered office.

To raise significant capital through equity, an OPC would typically need to convert to a PvtlimitedCo.

There are several important differences between a PvtlimitedCo and a LLP:

PvtlimitedCoo

PvtlimitedCo have shareholders, and their shares are privately held, meaning they cannot be traded on public stock exchanges.

A PvtlimitedCo are often seen as more credible, which can make it easier to do business with other companies.

A PvtlimitedCo is a seperate legal entity. It can sue or be sued for its property & enter into legally binding contracts.

Companies Act, 2013 makes it mandatory for PvtlimitedCo to maintain their books of account at the registered office.

A PvtlimitedCo can raise capital by issuing shares to investors, venture capitalists, or angel investors easily.

LLP

owned by two or more individuals called partners, who share profits and losses of the business in a predetermined ratio as defined in the LLP Agreement.

LLPs have a more formal structure than traditional partnerships, offering credibility & trust.

An LLP is a separate legal entity, distinct from its partners. It provides limited liability protection to partners.

LLPs are required to maintain proper books of accounts and comply with statutory requirements, similar to PvtlimitedCo.

Attracting external investors can be challenging compared to PvtlimitedCo due to the nature of profit-sharing among partners.

There are several important differences between a PvtlimitedCo and a public limited company:

PvtlimitedCo

PvtlimitedCo have shareholders, and their shares are privately held, meaning they cannot be traded on public stock exchanges.

A PvtlimitedCo are often seen as more credible, which can make it easier to do business with other companies.

A PvtlimitedCo is a seperate legal entity. It can sue or be sued for its property & enter into legally binding contracts.

Companies Act, 2013 makes it mandatory for PvtlimitedCo to maintain their books of account at the registered office.

A PvtlimitedCo can raise capital by issuing shares to investors, venture capitalists, or angel investors easily.

Public Limited Company

With a minimum of seven shareholders and no upper limit. Its shares can be freely traded on a stock exchange (listed company) or remain privately held (unlisted company).

Public limited companies are generally perceived as more established and credible due to their size and public listing.

A public limited company is a separate legal entity with perpetual succession, capable of entering into contracts and owning property.

Public limited companies are subject to stringent accounting and reporting standards, including mandatory audits and public disclosure of financial information.

Public limited companies have the most accessible way to raise capital by issuing shares to the public through an Initial Public Offering (IPO), providing a vast pool of potential investors.

Here are some common questions we receive from our customers. If you have any additional questions, please don’t hesitate to contact us.

A PvtlimitedCo means a company having a minimum paid-up share capital as prescribed, and which by its article -

It’s not necessary to form a Privatelimited in order to start a business. Also, a Pvtlimited is only one of several ways to structure a business. Other possibilities include: Partnership, LLP, Public Limited, sole proprietorship, Sec 8 Co, Trust, and Society.

The Minimum required for the incorporation of a Pvtlimited are:

At the time of Incorporation of a Pvtlimited Co, the company needs to provide an address proof. The Ministry of Corporate Affairs (MCA) allows a residential address to be used as the company’s registered address. Thus any address can be provided as the registered address

Incorporating a company in Singapore as a local is a relatively straightforward process. All you need is the following:

Both LLPs and PvtlimitedCo protect owners’ personal assets from business liabilities or debts. But they have some key differences, including:

PvtlimitedCo is a better option to start a new business journey than a public limited company. Though both the companies have stringent compliances, private limited companies serves as a better result in entrepreneurship. There are also limited requirements to start up a new PvtlimitedCo. A minimum of two shareholder and two directors is required.

Memorandum of Association (MOA) is defined under section 2(56) of the Companies Act 2013. It is the foundation on which the company is built.

It defines the constitution, powers and objects of the company. The Articles of Association (AOA) is defined under section 2(5) of the Companies Act.

It details all the rules and regulations relating to the management of the company.

Bhumik Lalka

Owner, Spring Digital

Great experience, Shivam understands your need and help in a best way to comply with never ending Indian rules and regulations.

Mohammad Yusuf

Mega Iron & Steel Enterprises

We got our proprietorship company converted to partnership firm along with GST registration.. Excellent service

Sameer Khan

RK Networks PvtlimitedCo

I had a great experience with the company that helped with my PvtlimitedCo registration. The team was professional, responsive, and made the process smooth.

Jai Jain

Kush Enterprises

Good experience and amazing service.

Get expert guidance on business setup, compliance, and international expansion. Contact us today to take your business to the next level.

+91 63003 47380, +91 87900 59682