Choose a Plan

Private Limited Company Registration in Bihar (ROC-Patna)

Below, we discuss how to register a Private Limited Company in Bihar

Choose a plan that best suits your needs

Start-up Plan

The above mentioned professional fees is for 2 members with Authorised Share Capital of Rs 1,00,000.

Includes:

Instant Drafting, filing & Consultation with CA/CS

DSC for Shareholders & Directors

4 Name reservation choices & Instant filing in 24hrs

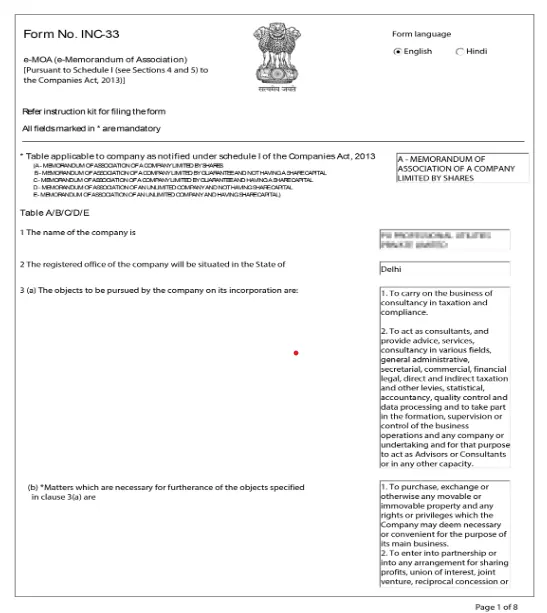

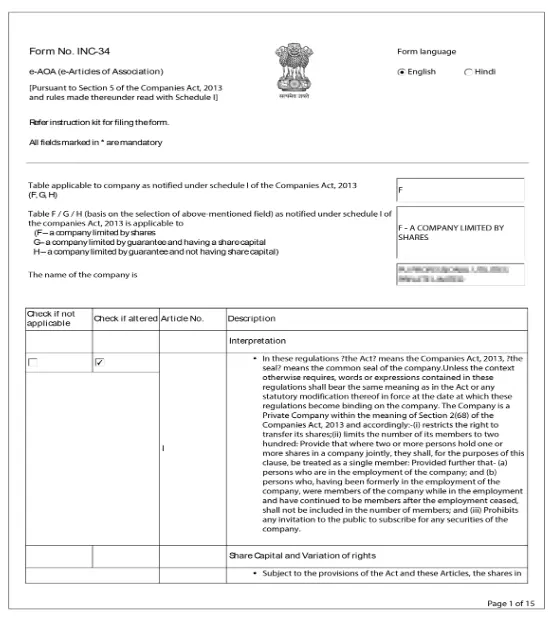

MOA & AOA Instant Drafting in 24hrs

SPICe+ form Instant filing in 24hrs

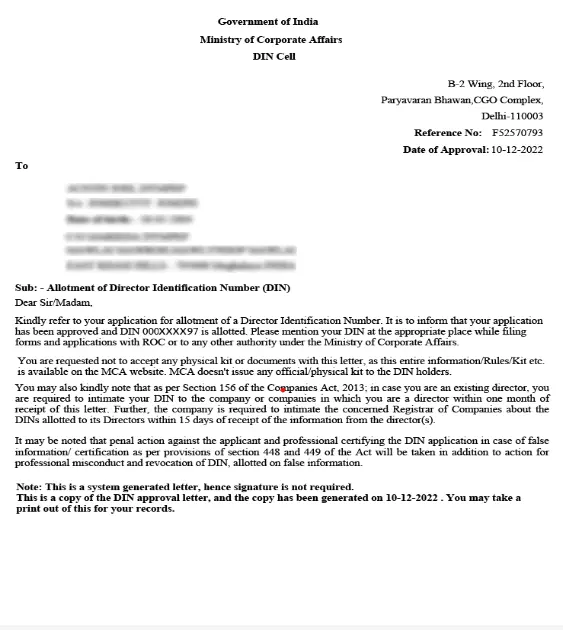

Allotment of CIN & 2 DINs in 7 days

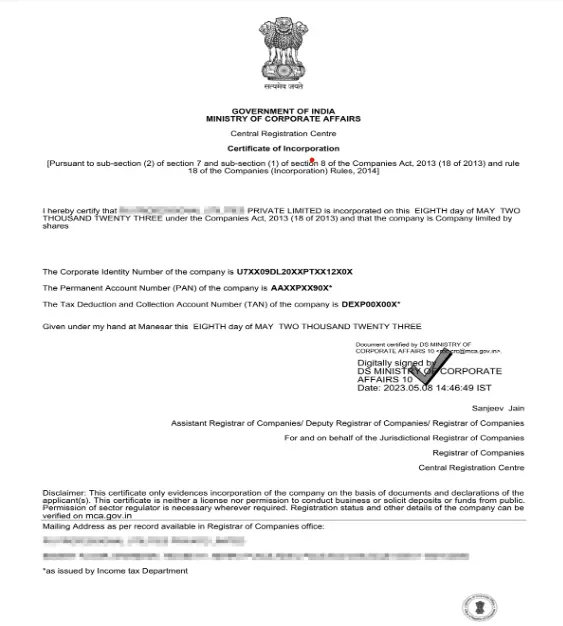

Incorporation certificate in 7 days

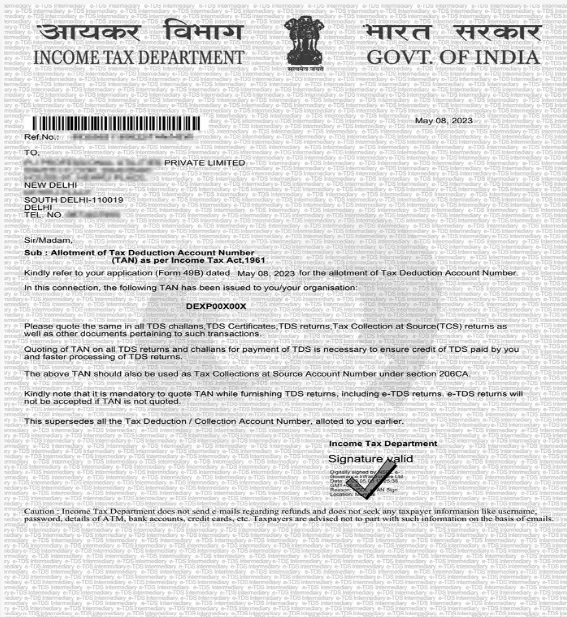

PAN, TAN, ESI & PF Registration in 7 days

Free Bank Account opening

Essential plan

Ensure your new Pvt Ltd Co is fully compliant with MCA regulations through expert CA & CS review.

Includes:

Start-up plan, plus

Instant INC 20A filing (Commencement of Business)

Instant ADT-1 filing (Appointment of Auditor)

Issuance of Share certificate by CS

GST Registration in 24hrs

Consent Letter drafting by CS

Board Resolution Drafting by CS

GST Filing for 2 months by CA

Advance Plan

We will take care of all your compliances so that you don't need to worry.

Includes:

Essentials, plus

MCA annual return filing and DIR-3 Director KYC

Dedicated CS for ROC Compliance for 1 year

Facilitation of Annual General Meeting

GST, TDS, ESI, PF filing for 6 months

Financial Statement preparation

Accounting & Bookeeping by CA for 1 years

Income Tax Return filing

Satisfaction guaranteed or get your money-back Learn more.

5.0 Google reviews

Reviews 4,568 • Execellent

About Private Limited Company Registration in Bihar

Most entrepreneurs and businessmen in Bihar prefer to form a private limited company for their business as it limits the personal liability of its owners. This means that the shareholders are only liable for the amount they have invested in the company and are not personally responsible for its debts or obligations, unlike sole proprietorship or partnership.

Other benefits of a private limited company are increased business credibility, ease of raising capital, ease of forming and maintaining, and its status as a distinct legal entity, which makes it the most favoured choice of business structure in Bihar.

If you wish to incorporate a Private Limited Company in Bihar, Chartered ONE is the best option, as it simplifies the incorporation process for you with expert guidance and a hassle-free experience, Connect today!

Who needs to apply for Private Limited Company Registration

The following individuals or entities shall apply for registration of a Private Limited Company in Bihar:

Small to Medium-Sized Businesses

Existing Sole Proprietors

Entrepreneurs or Startups

Partnerships

Foreign Investors

Existing LLPs

How to incorporate Private Limited Company in Bihar with Chartered ONE?

Select the perfect plan that fits your needs and budget. Compare features and benefits to find your ideal option.

Pay fee

Pay for services rendered, our pricing is transparent with no hidden costs. If you are unsatisfied, we will get you a refund

Upload Documents

Upload your documents securely and efficiently through our easy-to-use platform.

Get your company registered

Sit Back & relax, we will register your company effortlessly with our streamlined process.

Document required for Private Limited Company Registration in Bihar

The following documents are required for registering a Private Limited Company in Bihar:

Aadhaar copy of all the directors and shareholders

PAN of all directors and shareholders

Passport size photo of all the directors and shareholders

Copy of utility bill (water/gas/electricity) of the rented property

Rental agreement copy if the registered office is rented.

No Objection Certificate from the owner of the property